Defining an Ideal Customer Profile is a rite of passage for most early-stage startups, but it’s often built on fiction. Founders rush to fill out templated profiles before any real market feedback, locking themselves into imagined segments that don’t convert. If your targeting and positioning strategy is already in place, the next step is making it real by figuring out who actually engages, buys, and sticks. That’s what a working ICP is for. This piece breaks down the problem with treating your ICP as a static artifact, and offers a clearer way to approach it as a working hypothesis. It challenges early teams to rethink what “ideal” really means when nothing is proven yet and lays out a lean process for turning guesses into traction.

What even is an Ideal Customer Profile as a startup?

Your Ideal Customer Profile (ICP) is the type of customer most likely to buy, stick around, and grow with your startup. Think of it as the blueprint for repeatable, healthy growth. It guides your outreach, your messaging, even your product roadmap.

Unlike a buyer persona (which focuses on user behavior), your ICP defines the business-level fit that determines sales traction. A well-shaped ICP saves your startup time, money, and morale by preventing you from building for “everyone” and ending up with “no one.”

But here’s the catch: most early-stage ICPs are made up.

Why most startup ICPs are total fiction?

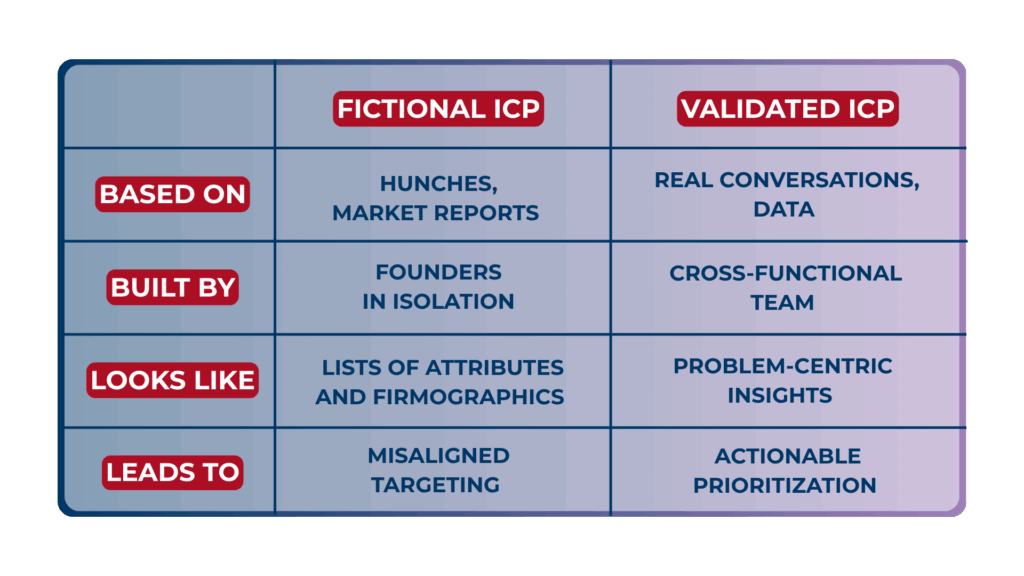

Early-stage founders are often told to define their ICP from day one. The result? Overly detailed templates filled with educated guesses, team brainstorms, or market research snapshots. Without actual customer data, these ICPs become fictional profiles of who you wish would buy from you.

Many founders over-optimize too early, locking into narrow verticals based on wishful thinking or investor pressure. Instead of letting data shape their ICP over time, they reverse-engineer it to match a storyline.

The fallout: wrong marketing message, wrong target audience, wasted energy.

The real job of an early-stage ICP

At this stage, your ICP doesn’t need to be correct. It needs to be useful. It should start conversations, point your team in a testable direction, and help you say “no” to bad-fit leads. ICP Version 0 is a compass, not a contract. Its purpose is clarity, not precision.

Your early ICP sets the foundation for shared understanding across your team. It helps everyone align on where to focus, what to test, and how to learn. At this stage, it functions more as a working hypothesis than a final answer, one built to reduce uncertainty, not resolve it entirely. Your first ICP should come from a mix of instinct and interaction.

Here’s a lean approach that any team can run:

Each loop through this cycle makes your ICP more accurate, not in theory, but in results. The key is iteration. You should treat your ICP like a living document, updated regularly with each new insight from the field.

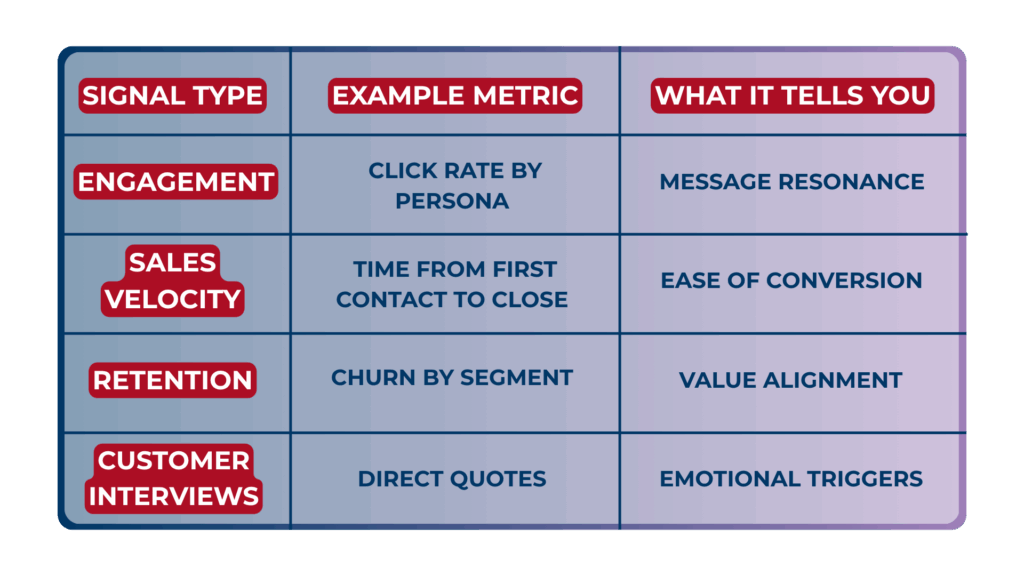

Data is your best co-founder

Refining your ICP is about staying close to the ground. Use data from sales calls, CRM notes, and customer feedback to continuously improve your understanding of who converts and why.

Schedule ICP reviews quarterly. Invite your sales, product, and customer teams. However, remember, the goal is not to finalize your ICP, but to evolve it. Your first iteration won’t be your last, but it will be your most important step toward clarity.

How Rydoo refined its ICP through market feedback

Rydoo, a startup offering expense management software, initially focused its outreach on small and mid-sized companies across Europe, assuming simplicity and price would appeal to lean teams. Early messaging centered on speed, ease of use, and paperless receipt tracking.

But early adoption patterns showed something else entirely. Unexpected traction came from larger, compliance-heavy organizations in countries like Germany and Brazil — segments they hadn’t prioritized. The team analyzed signups, engagement data, and feedback, revealing that finance and HR teams in regulated markets were the real drivers of urgency and purchase decisions.

In response, Rydoo revised its ICP. They focused on countries with complex tax rules, emphasized integrations with ERP systems, and adjusted messaging toward finance leaders navigating compliance.

The result: Germany became one of their strongest markets, contributing over 30% of ARR. Their ICP shifted from a broad SME focus to a targeted profile with real purchase power and urgency.

Your ICP is alive, now treat it like it matters

Your first ICP won’t be right. But it will help you focus. Done well, it turns random tactics into coordinated learning. Don’t get stuck in fictional models. Start with something real even if it’s rough.

Talk to people. Track what clicks. And update your ICP often, especially as your market funnel starts to show traction. And if you need help turning those insights into clear, consistent communication that reaches your ideal audience, our CMO Partner service can support you.